Exploring Different LLC Structures: Real-World Examples and Benefits

Ever wondered about the different ways businesses structure themselves for success? One popular choice is the Limited Liability Company, or LLC. But what does an LLC actually look like in practice? This exploration of LLC examples will help demystify this business structure and offer insights into how it can benefit entrepreneurs like you.

Let's dive into the world of LLCs. They're a popular choice for businesses of all sizes, from solopreneurs to larger companies. But understanding the nuances of LLC formation and operation can be tricky. This is where real-world LLC examples become invaluable. They provide concrete illustrations of how different businesses utilize the LLC structure to their advantage.

The LLC emerged as a way to combine the benefits of sole proprietorships and corporations. It offers the limited liability protection typically associated with corporations while retaining the pass-through taxation of sole proprietorships or partnerships. This hybrid structure has proven attractive to many, making LLCs a common business model in today's landscape. The flexible nature of LLCs is a major draw, accommodating diverse business needs and ownership structures.

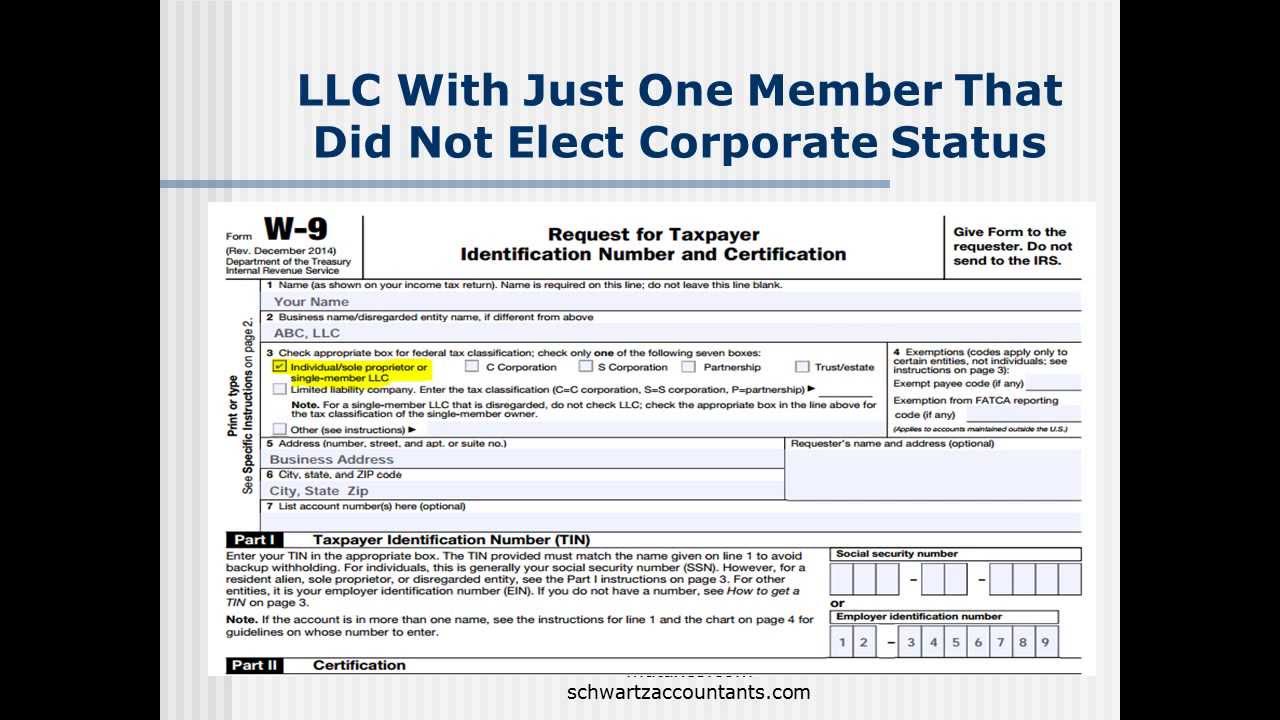

One of the central issues surrounding LLC formation is choosing the right structure. Single-member LLCs are straightforward for solo entrepreneurs, while multi-member LLCs offer a framework for businesses with multiple owners. Understanding the implications of each structure, including management styles and operating agreements, is crucial for successful LLC operation. Another key consideration is adhering to state-specific regulations, which can vary considerably.

Simply put, an LLC is a business structure that provides limited liability protection to its owners. This means personal assets are generally shielded from business debts and lawsuits. For example, if a single-member LLC faces a lawsuit, the owner's personal assets like their house or car are typically protected. This separation of personal and business liabilities is a major advantage of the LLC structure.

One key benefit of forming an LLC is the limited liability protection it offers. This safeguards personal assets from business debts and lawsuits. Another advantage is the flexibility in taxation. LLCs can choose to be taxed as a sole proprietorship, partnership, S corporation, or C corporation, allowing for potential tax advantages. Finally, LLCs are often easier to administer than corporations, with fewer administrative burdens and paperwork requirements.

If you're considering forming an LLC, a step-by-step guide can be incredibly helpful. First, choose a name for your LLC and ensure it complies with state regulations. Then, file the Articles of Organization with your state's relevant agency. Next, create an operating agreement outlining the ownership structure and management responsibilities. Finally, obtain any necessary licenses and permits to operate your business legally.

Advantages and Disadvantages of LLCs

| Advantages | Disadvantages |

|---|---|

| Limited Liability Protection | Limited Life in Some States |

| Flexible Taxation | Less Established Legal Precedents than Corporations |

| Simplified Administration | Varying State Regulations |

Best Practices for LLC Operation: 1. Maintain separate bank accounts for personal and business finances. 2. Document all business transactions meticulously. 3. Adhere to the terms outlined in your operating agreement. 4. Stay informed about changes in state LLC regulations. 5. Consult with legal and financial professionals for guidance.

Examples of LLCs: 1. A freelance writer operating as a single-member LLC. 2. A small e-commerce business structured as a multi-member LLC. 3. A real estate investment company utilizing an LLC for asset protection. 4. A group of consultants forming an LLC to offer their services jointly. 5. A restaurant operating as an LLC to manage liability.

Frequently Asked Questions: 1. What is an LLC? 2. How do I form an LLC? 3. What are the tax implications of an LLC? 4. How do I manage an LLC? 5. What is an operating agreement? 6. What are the benefits of an LLC? 7. How do I dissolve an LLC? 8. Where can I find more information about LLCs in my state?

Tips and Tricks for LLC Success: Regularly review your operating agreement. Consult with a tax professional to optimize your tax strategy. Maintain accurate and up-to-date records of all business activities.

In conclusion, understanding LLC examples is essential for anyone considering this business structure. From limited liability protection to flexible taxation and simplified administration, LLCs offer numerous advantages. While challenges exist, careful planning and adherence to best practices can pave the way for LLC success. By exploring real-world LLC examples and seeking expert advice, entrepreneurs can confidently navigate the complexities of LLC formation and operation, building a solid foundation for their business ventures. Take the time to research the specific requirements in your state and consult with legal and financial professionals to make informed decisions. This proactive approach will empower you to harness the full potential of the LLC structure and achieve your business goals. Whether you're a freelancer, small business owner, or part of a larger enterprise, exploring the possibilities of an LLC can unlock new opportunities for growth and stability.

Exploring the beauty of short spanish rhyming poems

Unlocking the secrets of top tier medicare part b coverage

Captivating whatsapp status updates original phrases that shine