LLC Examples Decoded Your Business Structure Guide

So, you're thinking about starting a business. Good for you! But before you dive headfirst into the exhilarating (and terrifying) world of entrepreneurship, you need to figure out the nitty-gritty stuff. Like, what kind of legal structure will your business have? One popular choice is the Limited Liability Company, or LLC. But what does that even *mean*? And more importantly, what are some actual, real-life examples of LLC company structures?

Let's break it down. An LLC is a business structure that offers the limited liability protection of a corporation with the pass-through taxation of a sole proprietorship or partnership. Think of it as a hybrid, a best-of-both-worlds scenario. This means your personal assets are generally protected from business debts and lawsuits, while you avoid the double taxation that corporations face.

LLCs have become increasingly popular over the years, and for good reason. They offer a flexible structure that can be adapted to a variety of businesses, from single-member operations to multi-member partnerships. But navigating the world of LLCs can feel like trying to understand ancient hieroglyphics. That's why understanding LLC company examples is crucial.

Historically, LLCs emerged as a way to combine the best aspects of corporations and partnerships. They addressed the need for a business structure that provided liability protection without the complexities and tax burdens of a corporation. This has made them a cornerstone of the modern business landscape.

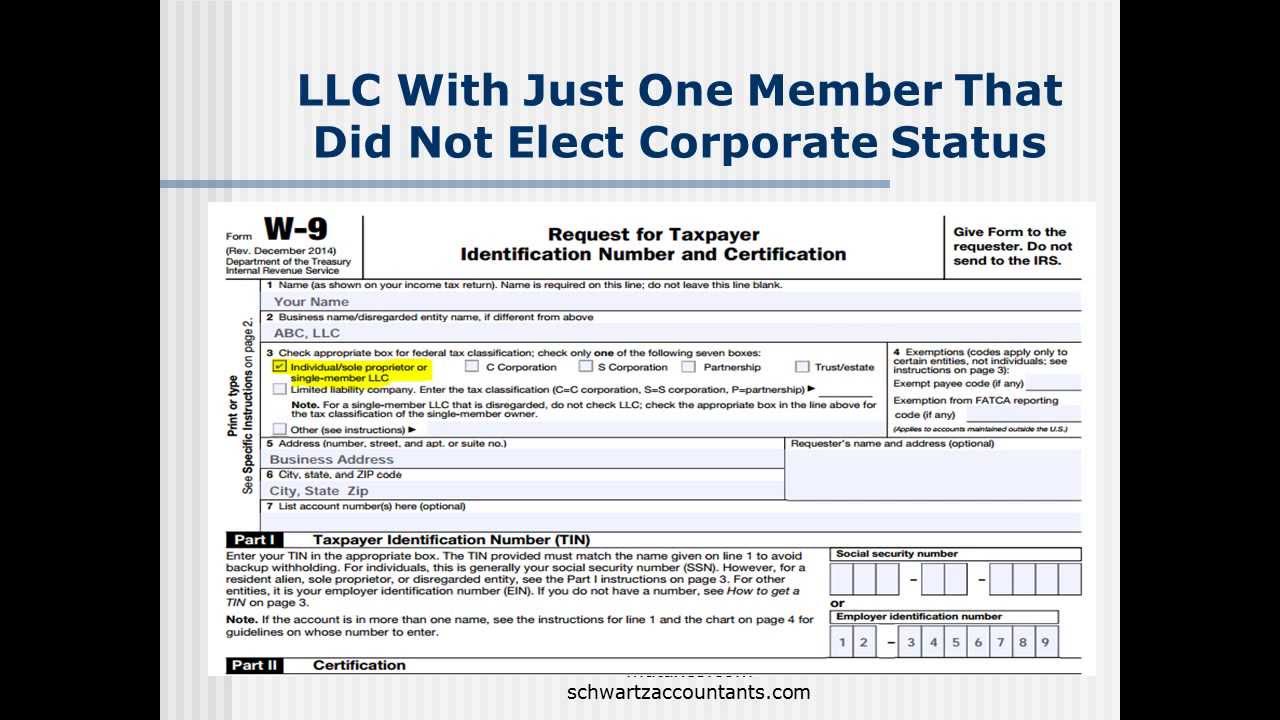

Now, let's get into the meat and potatoes. What are some concrete examples of LLC company types? A single-member LLC is perfect for solopreneurs, like a freelance writer or a consultant. Multi-member LLCs are ideal for businesses with multiple owners, such as a group of designers starting a web design agency. Then you have more specialized LLCs, like a real estate LLC, designed specifically for holding and managing real estate properties.

One benefit of forming an LLC is the liability protection it provides. For example, if your e-commerce LLC is sued, your personal assets like your house and car are generally protected. Another advantage is the flexibility in taxation. An LLC can choose to be taxed as a sole proprietorship, partnership, S corporation, or C corporation. This allows for optimized tax strategies. Finally, LLCs are relatively easy to manage compared to corporations, with less paperwork and fewer formalities.

To form an LLC, you'll need to choose a name, file articles of organization with your state, create an operating agreement, and obtain the necessary licenses and permits. Successful examples include tech startups, law firms, and small retail businesses utilizing the LLC structure.

Some real-world LLC examples include a local bakery operating as a single-member LLC, a group of doctors forming a multi-member LLC for their medical practice, a real estate investment firm structured as an LLC, a popular online clothing retailer functioning as an LLC, and a freelance graphic designer using a single-member LLC.

Advantages and Disadvantages of LLCs

| Advantages | Disadvantages |

|---|---|

| Limited Liability | Limited Life in Some States |

| Tax Flexibility | Less Established Legal Precedent |

| Management Flexibility | Self-Employment Taxes |

One common challenge is piercing the corporate veil, which can occur if personal and business finances are commingled. The solution is to maintain separate bank accounts and meticulous financial records. Another challenge is understanding the varying state regulations for LLCs. The solution is to consult with a legal professional or use online resources specific to your state.

FAQ: What is an LLC? How do I form an LLC? What are the tax benefits of an LLC? What is an operating agreement? What is piercing the corporate veil? Can an LLC have employees? How do I dissolve an LLC? What are the different types of LLCs?

A tip for managing your LLC effectively is to keep detailed records of all business transactions. This will simplify tax preparation and help maintain the separation between your personal and business finances, crucial for preserving your liability protection.

In conclusion, understanding the nuances of LLCs is essential for any aspiring entrepreneur. The examples of LLC company structures we've explored demonstrate the versatility and benefits this structure offers. From the liability protection to the flexible taxation, LLCs provide a robust framework for businesses of all sizes and industries. Take the time to research, plan, and consult with professionals to determine if an LLC is the right fit for your entrepreneurial journey. The right legal structure is the foundation upon which your business success is built. Taking the time to understand the complexities of LLCs and finding relevant examples that resonate with your business aspirations will pay dividends in the long run. It empowers you to make informed decisions, mitigate risks, and ultimately, build a thriving and sustainable enterprise. Don't hesitate to explore further and seek expert advice to ensure your business is legally sound and positioned for success.

Blooming borders beautiful high resolution floral designs

Transform your space with sherwin williams billowy breeze

Ron jon surf shop cocoa beach experience