Navigating Bank Rakyat's Death Benefit Scheme

Death, an inevitable chapter in life, often leaves families grappling with emotional turmoil and financial burdens. In Malaysia, Bank Rakyat’s Death Benefit Scheme, often referred to as *Khairat Kematian*, offers a crucial safety net. But how does this system work, and how can you navigate the process of applying for this benefit when a loved one passes away?

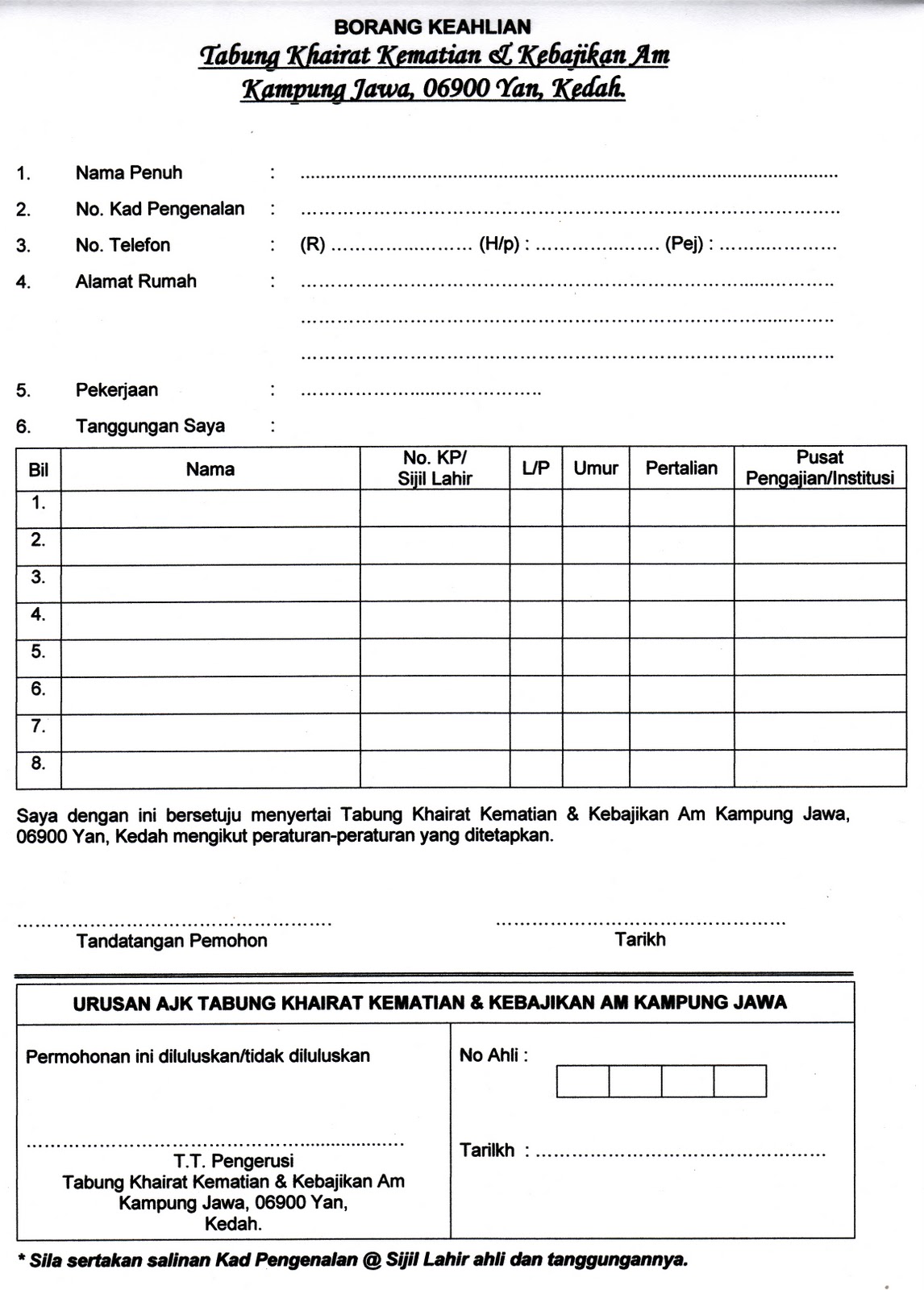

The *Borang Khairat Kematian Bank Rakyat*, essentially the Death Benefit Application Form, is a crucial document in accessing this financial aid. This guide aims to decode the intricacies of the scheme, breaking down the application process, eligibility criteria, and the significance of understanding the nuances of the *Khairat Kematian Bank Rakyat* process.

Imagine a family suddenly facing unexpected expenses after a loved one's passing. Funeral arrangements, outstanding debts, and daily living costs can quickly become overwhelming. The *Borang Khairat Kematian* from Bank Rakyat aims to alleviate some of this financial strain, providing a much-needed lifeline during a difficult time. Understanding how to access this benefit is vital for those eligible.

Navigating the bureaucratic processes associated with death benefits can be daunting, especially while grieving. This article will dissect the requirements and procedures related to the Bank Rakyat Death Benefit Scheme, providing a clear roadmap for those seeking to access the *Khairat Kematian* funds.

From understanding the eligibility criteria to completing the *Borang Khairat Kematian Bank Rakyat* accurately, we'll cover the essential steps involved. We’ll also delve into common issues encountered during the application process, offering solutions and advice to ensure a smooth and efficient experience.

The Bank Rakyat Death Benefit Scheme, or *Khairat Kematian*, was established to provide financial assistance to the beneficiaries of deceased Bank Rakyat members. This scheme serves as a form of social responsibility by the bank, aiming to alleviate financial burdens on families during times of bereavement. The exact origins and historical evolution of this scheme within Bank Rakyat's portfolio of services requires further research directly with the bank.

The *Borang Khairat Kematian Bank Rakyat* is the official application form required to access the death benefit. This form typically requires details of the deceased member, the beneficiary, and supporting documents such as the death certificate. This form is pivotal because it initiates the process of releasing the benefit to the eligible beneficiary. Without a correctly completed *Borang Khairat Kematian*, the process can be delayed or even halted.

One key benefit of the *Khairat Kematian Bank Rakyat* is the financial relief it provides. This lump-sum payment can assist with funeral expenses, outstanding debts, and ongoing living costs for the family. Additionally, the scheme offers a degree of financial security and peace of mind to Bank Rakyat members, knowing that their families will receive some support in the event of their passing. Another benefit is the relatively straightforward application process, although navigating the *Borang Khairat Kematian* can sometimes present challenges.

While obtaining precise figures requires contacting Bank Rakyat directly, several online forums and community discussions mention sums ranging from a few thousand to tens of thousands of Ringgit, depending on factors such as the deceased's membership status and contribution history. It's always recommended to consult with Bank Rakyat for the most up-to-date information regarding the benefit amount.

Advantages and Disadvantages of Bank Rakyat's Death Benefit

| Advantages | Disadvantages |

|---|---|

| Financial Relief for Beneficiaries | Potential Delays in Processing |

| Relatively Straightforward Application | Specific Eligibility Requirements |

| Peace of Mind for Members | Benefit Amount May Not Cover All Expenses |

Frequently Asked Questions:

1. What is *Khairat Kematian Bank Rakyat*? It is a death benefit scheme provided by Bank Rakyat to eligible beneficiaries of deceased members.

2. Who is eligible? This depends on the deceased's membership status with Bank Rakyat. Contact the bank for details.

3. How do I apply? By completing and submitting the *Borang Khairat Kematian Bank Rakyat* along with required documents.

4. Where can I get the form? From Bank Rakyat branches or potentially online.

5. What documents are needed? Typically, a death certificate, proof of relationship to the deceased, and other supporting documentation as specified by Bank Rakyat.

6. How long does the process take? This can vary, but it's best to inquire directly with Bank Rakyat.

7. What is the benefit amount? The amount depends on various factors and should be confirmed with Bank Rakyat.

8. Who do I contact for assistance? Contact Bank Rakyat’s customer service for guidance.

In conclusion, the *Borang Khairat Kematian Bank Rakyat*, the cornerstone of the Bank Rakyat Death Benefit Scheme, offers vital financial support to families coping with loss. Understanding the application process, eligibility criteria, and the significance of the *Khairat Kematian* benefit can empower individuals to navigate this challenging period with greater ease. While navigating bureaucratic processes during bereavement can be daunting, resources like this guide aim to simplify the journey and ensure that eligible beneficiaries receive the support they deserve. Don’t hesitate to contact Bank Rakyat directly for personalized guidance and assistance with completing the *Borang Khairat Kematian* and accessing this crucial benefit. Taking proactive steps to understand this scheme can provide significant peace of mind for both Bank Rakyat members and their loved ones.

Mirror mirror unleashing the power of feng shui reflections

Unlock serenity with benjamin moore cloud cover the ultimate guide

Finding your path health and wellness journeys in conway