Sending Money Abroad with Western Union and IBANs

In today's interconnected world, transferring money across borders has become a common necessity. Whether supporting family abroad, paying international invoices, or managing overseas investments, the ability to move funds quickly and securely is crucial. One popular method is sending money through Western Union to an International Bank Account Number (IBAN). This approach combines the extensive reach of Western Union with the specificity and security of IBANs, offering a potentially convenient solution for international transfers.

Western Union has long been synonymous with money transfers. Founded in 1851 as a telegraph company, it quickly evolved into a financial services provider, pioneering the concept of wiring money. Today, Western Union offers a range of services, from in-person cash pickups to bank account transfers. Integrating IBANs into their system allows for more precise and efficient transfers to accounts in many countries.

The IBAN itself is an internationally agreed-upon system for identifying bank accounts. It acts like a global address for your bank account, eliminating ambiguity and reducing the risk of errors during international transactions. Sending money via Western Union to an IBAN offers a level of certainty, ensuring that funds reach the correct recipient account.

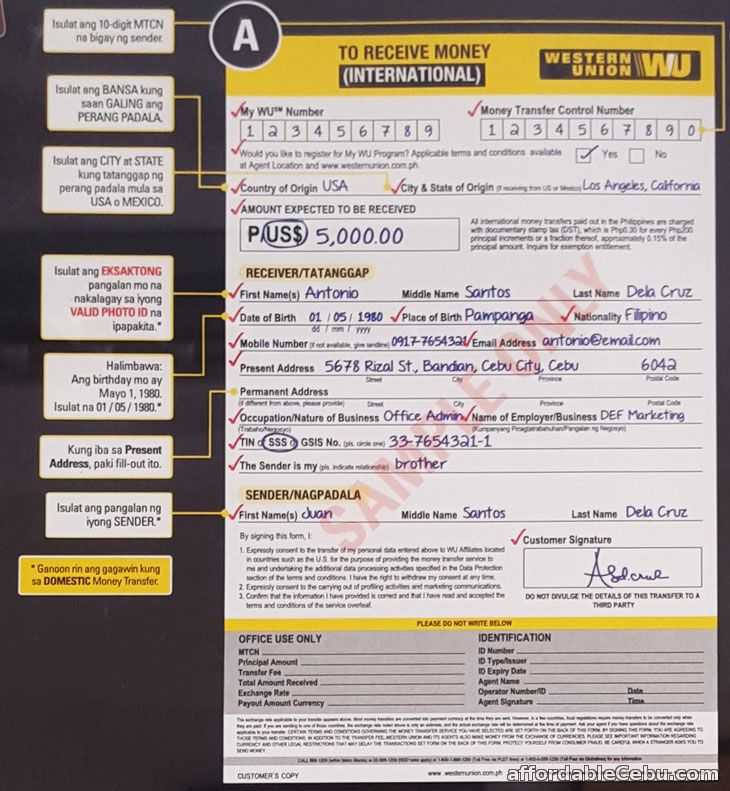

Using Western Union for IBAN transfers allows you to leverage their wide network of agent locations. This can be particularly useful if you need to send money to someone in a region with limited access to traditional banking services. The recipient can collect the funds in cash at a designated Western Union agent location or have the money deposited directly into their IBAN account.

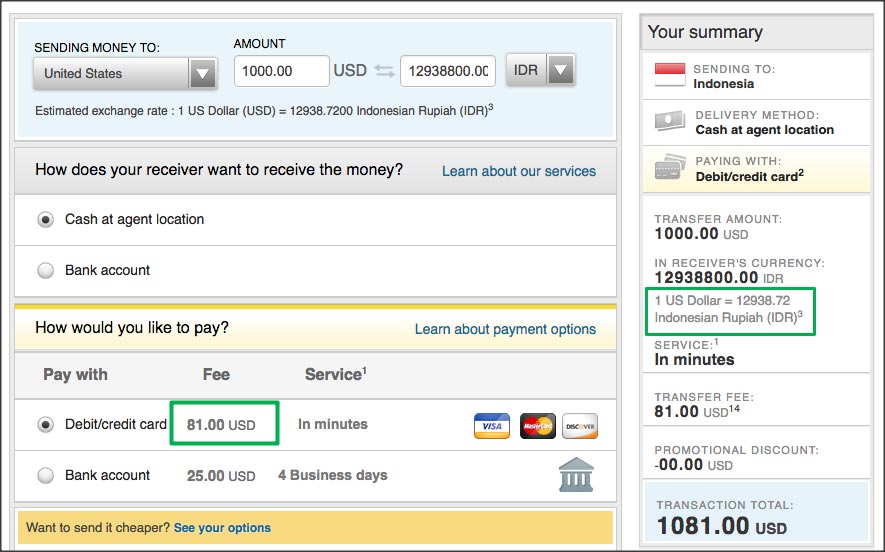

However, sending money via Western Union to an IBAN also has important considerations. Transfer fees and exchange rates can vary significantly, and understanding these costs upfront is essential. Additionally, while Western Union provides extensive security measures, being aware of potential fraud and scams is always important when making international money transfers.

While Western Union historically focused on cash transfers, they have expanded their services to include direct bank deposits. Using an IBAN facilitates this process by providing a standardized way to identify the recipient's bank account internationally.

One example is sending funds to a family member in Europe. Providing their IBAN allows for a direct transfer to their bank account, avoiding the need for them to physically collect cash. Another example is paying an invoice to a business partner in Asia. Using an IBAN ensures accurate and efficient payment.

Benefits of using Western Union with IBAN transfers include speed, convenience, and global reach. Speed: Transfers can often be completed within minutes or hours. Convenience: The sender can initiate the transfer online, through a mobile app, or at a Western Union agent location. Global Reach: Western Union operates in numerous countries, facilitating transfers to a wide range of destinations.

Advantages and Disadvantages of Western Union with IBAN Transfers

| Advantages | Disadvantages |

|---|---|

| Speed of transfer | Potentially higher fees compared to other methods |

| Global reach | Exchange rates may not always be the most favorable |

| Convenience | Need to be aware of potential scams |

Best Practices for Western Union and IBAN Transfers:

1. Verify the recipient's IBAN carefully.

2. Compare fees and exchange rates from different providers.

3. Be cautious of unsolicited requests for money transfers.

4. Keep transaction records for future reference.

5. Use strong passwords and security measures for online transfers.

Frequently Asked Questions:

1. What is an IBAN? Answer: An IBAN is an international bank account number.

2. How do I find my IBAN? Answer: Contact your bank or check your bank statement.

3. How long does a Western Union transfer take? Answer: It can vary, but often within minutes or hours.

4. What fees are associated with Western Union transfers? Answer: Fees vary depending on the amount, destination, and transfer method.

5. Is Western Union secure? Answer: Western Union employs security measures, but be aware of potential scams.

6. Can I cancel a Western Union transfer? Answer: Contact Western Union customer support as soon as possible.

7. How do I track a Western Union transfer? Answer: Use the tracking tool on the Western Union website.

8. What should I do if I suspect fraud? Answer: Contact Western Union and report the incident.

Tips and Tricks: Check for promotions and discounts offered by Western Union. Consider using a credit card for transfers to earn rewards points, but be mindful of potential fees.

In conclusion, transferring money via Western Union to an IBAN offers a blended approach to international fund transfers, leveraging the expansive network of Western Union and the precision of IBANs. Understanding the fees, exchange rates, security measures, and best practices is essential for a smooth and successful transfer. By carefully considering these factors and taking appropriate precautions, you can effectively utilize this method to send money abroad for various purposes. The convenience and speed of Western Union, combined with the accuracy of IBANs, offer a valuable tool in managing global finances. Take the time to research and compare options, and remember to always prioritize security when making international money transfers. Remember to be aware of any potential fees or exchange rate fluctuations.

Unlock serenity with behrs billowing clouds paint

Discovering 49 robinwood ave jamaica plain ma

Embark on an evolutionary journey reading big tree manga