Simplify Your Accounting: Mastering Excel Spreadsheets

Imagine effortlessly managing your finances, tracking every transaction with clarity and precision. Could Excel spreadsheets be the key to simplifying your accounting processes?

For many small businesses and individuals, Excel spreadsheets (hojas de excel para contabilidad in Spanish) serve as a vital tool for managing financial data. These digital workbooks offer a flexible and accessible way to organize income, expenses, and other financial information. This article delves into the practical applications of Excel in accounting, exploring its benefits, best practices, and potential challenges.

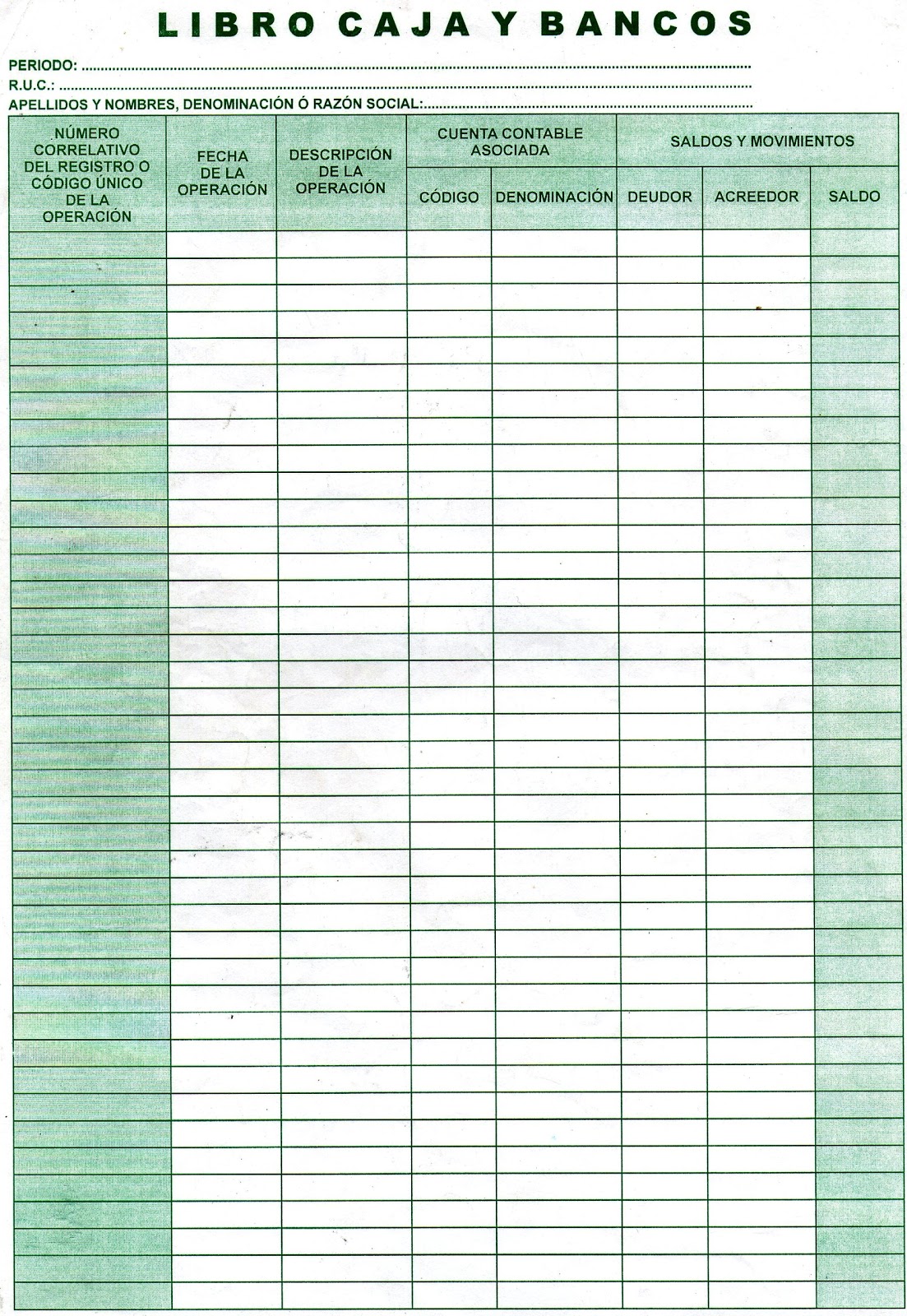

Before specialized accounting software became widely available, businesses often relied on physical ledgers and manual calculations. The advent of spreadsheet programs like Excel revolutionized accounting by automating many tedious tasks. Excel's ability to perform calculations, generate charts, and create custom reports made it an invaluable tool for managing financial records.

Accurate and well-organized accounting records are essential for making informed business decisions, complying with tax regulations, and maintaining financial stability. Excel spreadsheets can play a crucial role in achieving these goals. They provide a structured framework for recording transactions, calculating profits and losses, and generating financial reports.

However, using Excel for accounting also presents certain challenges. Ensuring data accuracy, maintaining data integrity, and managing complex spreadsheets can be time-consuming and require attention to detail. This article will address these challenges and offer solutions for maximizing the effectiveness of Excel in accounting.

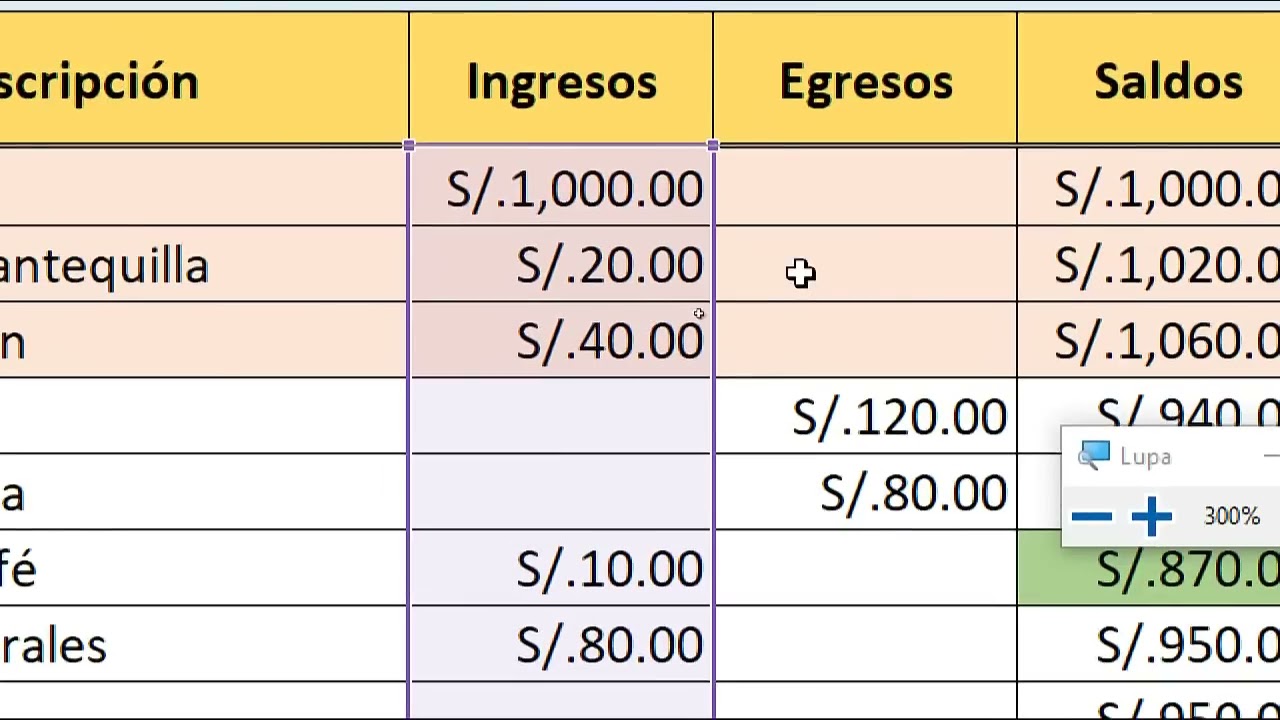

A simple example of using Excel for accounting is creating a budget. You can list your income and expenses in separate columns and use formulas to calculate your net income. You can also use charts to visualize your spending patterns and identify areas where you can save money.

One of the key benefits of using Excel for accounting is its flexibility. You can customize spreadsheets to meet your specific needs, creating templates for invoices, expense reports, and other financial documents. Excel's built-in functions and formulas simplify complex calculations, saving you time and effort.

Another advantage is accessibility. Excel is a widely available software program, often included in standard office software packages. Its user-friendly interface makes it relatively easy to learn and use, even for those with limited technical skills. Furthermore, countless online resources, tutorials, and templates are available to support users in their Excel accounting endeavors.

Excel spreadsheets offer valuable insights into your financial performance. By analyzing data in your spreadsheets, you can identify trends, track key performance indicators (KPIs), and make data-driven decisions to improve your financial health.

One best practice for using Excel in accounting is to regularly back up your data. This ensures that you don't lose valuable information in case of computer crashes or other unforeseen events. Regularly backing up to an external drive or cloud service helps safeguard your accounting information.

To organize your Excel accounting spreadsheets effectively, consider using separate worksheets for different categories of transactions, such as income, expenses, and assets. This approach improves data organization and simplifies report generation.

When inputting data into your spreadsheets, double-check for accuracy to prevent errors in calculations and reports. Employ data validation techniques where possible to ensure data integrity. This is particularly crucial for complex financial models.

Advantages and Disadvantages of Using Excel for Accounting

| Advantages | Disadvantages |

|---|---|

| Flexibility and Customization | Potential for Errors |

| Accessibility and Affordability | Limited Collaboration Features |

| Data Analysis and Reporting | Scalability Issues |

Several online resources offer support for learning and improving your Excel skills for accounting. Websites like Exceljet and Chandoo.org provide tutorials, templates, and forums where users can share tips and ask questions.

Frequently Asked Questions

Is Excel suitable for all businesses? - Excel can be sufficient for small businesses or freelancers. Larger organizations with more complex accounting needs might require dedicated accounting software.

Can I use Excel for tax reporting? - While Excel can help organize your financial data for tax reporting, it's important to ensure compliance with specific tax regulations and consult with a tax professional if needed.

(Six more FAQs related to Excel in accounting can be added here, focusing on topics such as data security, formula usage, and template creation.)

In conclusion, Excel spreadsheets remain a valuable tool for managing accounting information, particularly for individuals and small businesses. While there are inherent challenges in using any tool, utilizing best practices and understanding the limitations of spreadsheets enables you to harness the power of Excel for effective financial management. By embracing a mindful and organized approach to your Excel accounting practices, you can achieve greater clarity and control over your financial data, paving the way for informed decision-making and financial success.

Decoding cups pounds and ounces your kitchen conversion guide

Cimb bank shah alam seksyen 14 navigating your financial needs

Upgrade your home with sherwin williams wood stains