Stopping a Bank Pay Order: A Complete Guide

Have you ever needed to halt a payment you've already initiated through a bank pay order? The process can seem daunting, but with the right information, requesting a pay order cancellation is manageable. This comprehensive guide provides everything you need to know about stopping a bank pay order, including drafting the crucial cancellation letter, understanding the process, and navigating potential challenges.

A bank pay order, also known as a demand draft in some regions, is a prepaid instrument that guarantees payment to the recipient. It's often used for large transactions where a personal check might not be sufficient. Once issued, it can be challenging to cancel, but it's not impossible. Understanding the circumstances under which a cancellation is possible and the proper procedures to follow are critical.

The history of bank pay orders is intertwined with the evolution of banking and trade. These instruments provided a secure method of payment, especially across geographical distances, long before the advent of electronic transfers. They lessened the risk of carrying large sums of cash and provided a level of assurance to both the payer and the payee. Today, while digital payment methods are gaining traction, bank pay orders still hold relevance for specific transactions, particularly those requiring a guaranteed form of payment.

The primary issue related to cancelling a bank pay order lies in the inherent guarantee of payment. The bank, having issued the order, commits to paying the recipient. Therefore, stopping the payment requires a justifiable reason and adherence to the bank's specific procedures. The cancellation process typically involves submitting a formal request, often in the form of a pay order stop payment request letter, and providing supporting documentation. The complexity arises from the need to balance the payer's request with the bank's obligation to the payee and the potential legal implications.

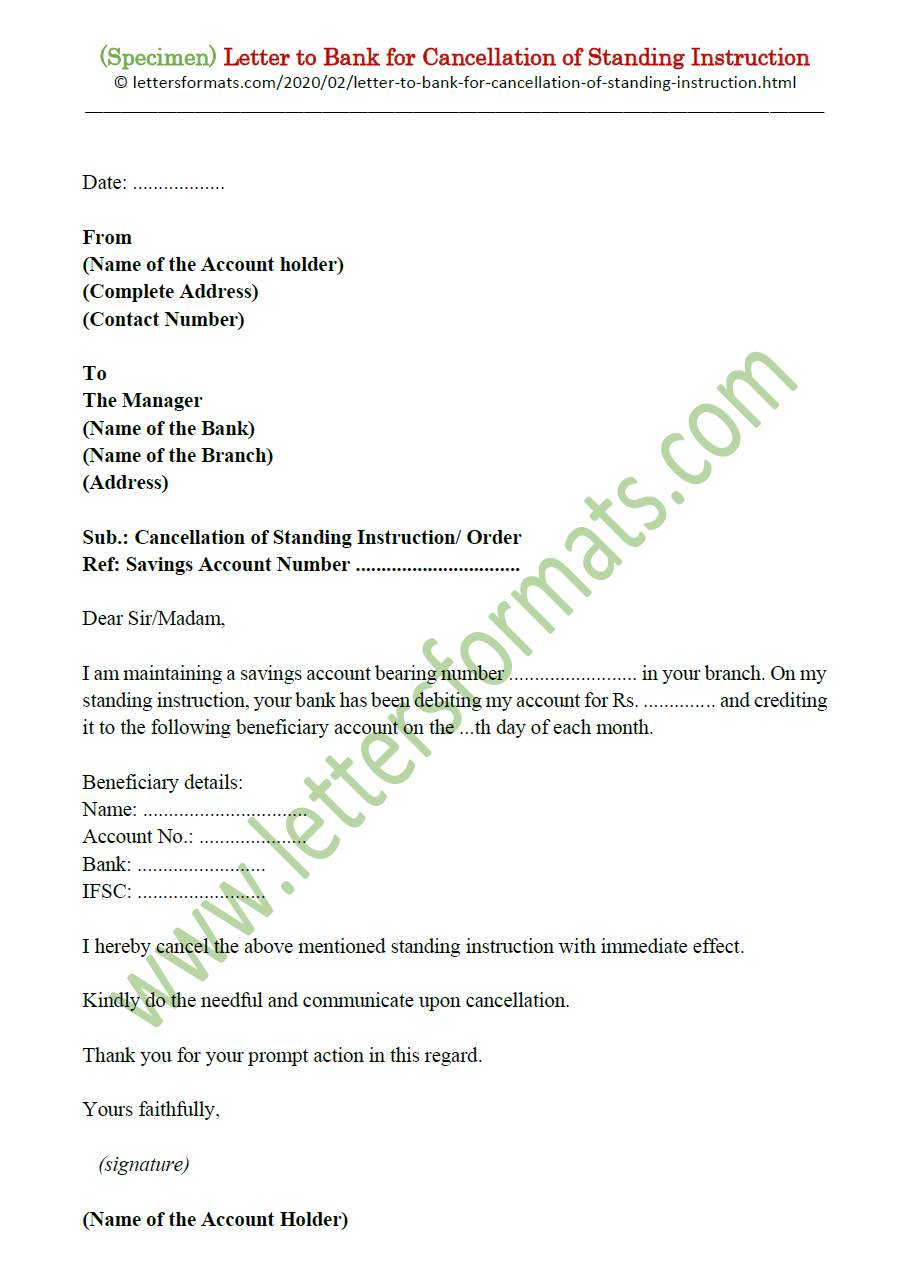

A pay order cancellation letter, also referred to as a pay order stop payment request, is a formal written communication to your bank requesting the cessation of a previously issued pay order. It must contain vital information such as the pay order number, date of issue, amount, payee name, and the reason for cancellation. Clear, concise, and accurate details in the letter are paramount for successful processing. A vague or incomplete request might delay or even prevent the cancellation.

One benefit of successfully canceling a pay order is avoiding potential financial loss if the order was issued in error, if the goods or services were not delivered as agreed, or in cases of fraud. Another advantage is the peace of mind that comes with rectifying a financial mistake before it impacts your account. Finally, it reinforces the importance of acting swiftly and decisively when dealing with financial matters.

To initiate a cancellation, contact your bank immediately upon realizing the need to stop the pay order. Gather all necessary information related to the pay order, including the pay order number, date, amount, and recipient details. Draft a formal letter explaining the reasons for the cancellation and provide any supporting documentation. Submit the letter and documentation to the bank and follow up regularly to ensure the request is being processed.

Advantages and Disadvantages of Requesting a Pay Order Cancellation

| Advantages | Disadvantages |

|---|---|

| Prevent financial loss due to errors or fraud | Not always guaranteed, especially if the pay order has been cashed |

| Rectify mistakes and maintain financial control | Can be time-consuming and require documentation |

| Provides peace of mind and prevents further complications | May involve fees or penalties |

Best practices include acting quickly, providing accurate information, maintaining clear communication with the bank, keeping records of all correspondence, and understanding the bank’s specific policies regarding cancellations.

Frequently Asked Questions:

1. How long does it take to cancel a pay order? This depends on the bank and the specific circumstances.

2. What if the pay order has already been cashed? Cancellation is typically not possible in this scenario.

3. Are there any fees associated with cancelling a pay order? This varies depending on the bank's policies.

4. Can I cancel a pay order online? Some banks offer online cancellation options, while others require a written request.

5. What happens if the recipient disputes the cancellation? This could lead to legal complications.

6. What if I don’t have the pay order number? Contact your bank immediately to retrieve the information.

7. Can I modify a pay order instead of cancelling it? Some banks allow modifications, but this depends on their specific policies.

8. What documentation do I need to provide for a pay order cancellation request? This varies depending on the reason for cancellation and the bank’s requirements.

Tips for a smoother process include keeping clear records of all financial transactions and understanding your bank’s specific policies regarding pay orders. Regularly reviewing your account statements can help identify any discrepancies early on.

In conclusion, understanding the process of requesting a bank pay order cancellation, including drafting an effective pay order cancellation letter or stop payment request, is crucial for managing your finances effectively. By understanding the procedures, potential challenges, and best practices outlined in this guide, you can navigate this process with greater confidence. The ability to stop or amend a payment you've initiated offers financial security and peace of mind. Remember to always act quickly, communicate clearly with your bank, and maintain accurate records. Take proactive steps to understand your bank's specific policies related to pay orders, and don't hesitate to reach out to your bank directly for further clarification or assistance. Proactive financial management is key to avoiding potential complications and maintaining control of your finances. It's always better to be informed and prepared, especially when dealing with important financial instruments like bank pay orders.

Leg tattoos for women ink stories and bold statements

Unlocking the magic of paper boats

Ram 1500 diesel fuel tank size and range everything you need to know