Unlocking Financial Clarity: Mastering Excel Spreadsheets for Accounting

Are you struggling to keep your finances organized and gain clear insights into your business's performance? In today's fast-paced business environment, having a solid grasp of your financial data is paramount. Excel accounting spreadsheets, often referred to as "hojas de trabajo en excel contabilidad" in Spanish, can be your secret weapon for achieving financial clarity and making informed decisions. This comprehensive guide will explore the power of Excel for accounting and provide you with practical strategies to optimize your financial management.

Excel, with its robust features and flexibility, has become a staple tool for accountants and business owners alike. From simple bookkeeping tasks to complex financial modeling, Excel's capabilities empower users to manage their finances effectively. Whether you're tracking income and expenses, creating budgets, or performing financial analysis, an Excel accounting spreadsheet (or "hoja de trabajo en excel contabilidad") can streamline your workflow and provide valuable insights.

The use of spreadsheets for accounting has a long history, evolving from manual ledger books to digital formats. The introduction of spreadsheet software like VisiCalc and Lotus 1-2-3 revolutionized accounting practices, paving the way for the ubiquitous use of Excel. The inherent flexibility and formula-driven nature of these programs allow for automation of calculations, reducing manual errors and saving time. This digital transformation has been particularly significant for "hojas de trabajo en excel contabilidad", facilitating more efficient financial management.

The importance of well-structured Excel accounting spreadsheets, or "hojas de trabajo en excel contabilidad," cannot be overstated. They provide a centralized location for financial data, enabling accurate record-keeping, efficient reporting, and informed decision-making. By utilizing formulas and functions, Excel automates calculations, reducing the risk of human error. Moreover, the ability to create charts and graphs visualizes financial data, making it easier to identify trends and patterns.

However, there are potential downsides to relying solely on Excel for complex accounting tasks. Issues like data integrity, version control, and scalability can arise as businesses grow and their financial data becomes more complex. While Excel remains a powerful tool for many accounting functions, businesses should consider dedicated accounting software for more robust features and control as their needs evolve. Understanding these limitations is crucial for effectively utilizing "hojas de trabajo en excel contabilidad".

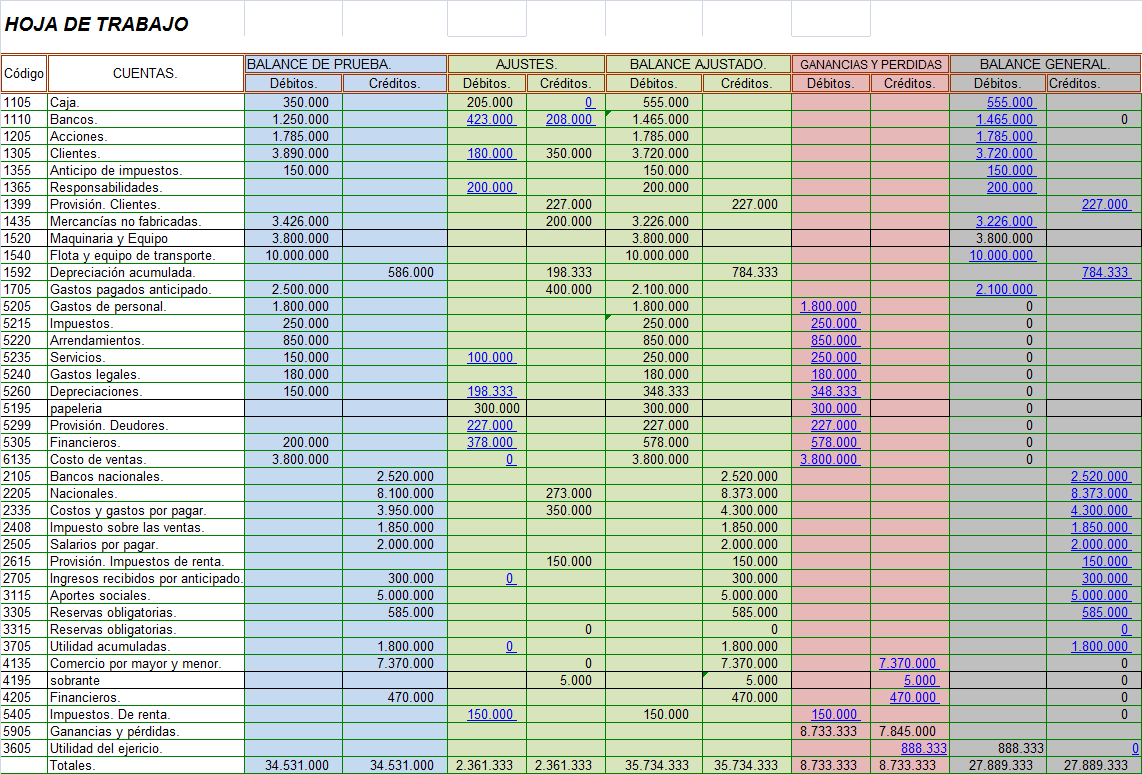

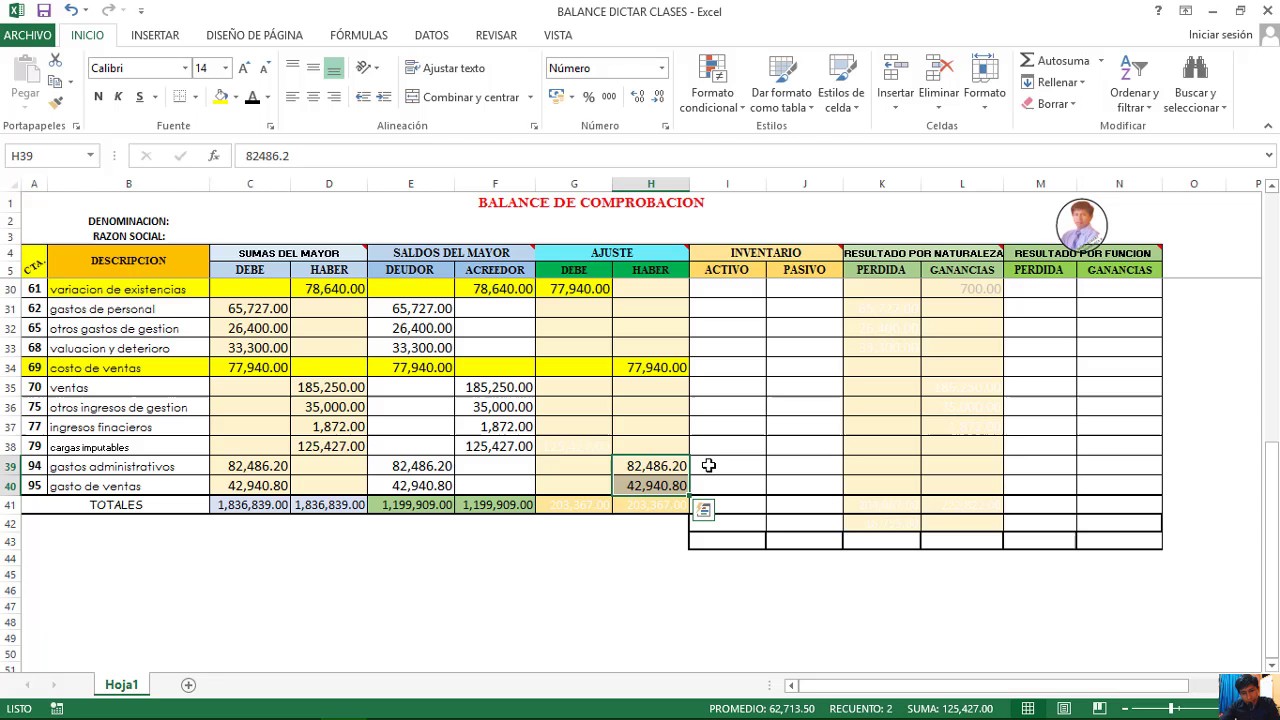

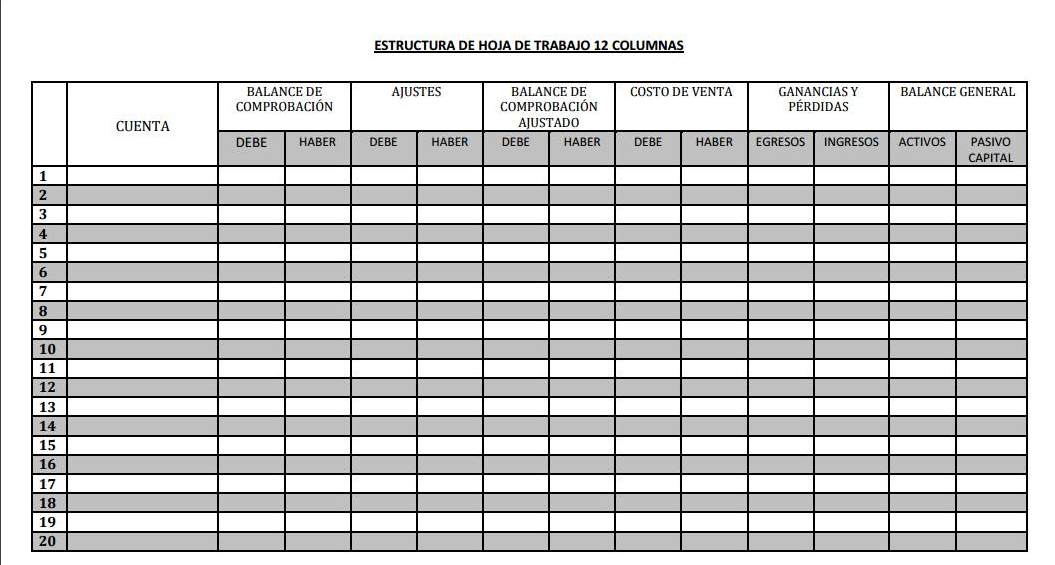

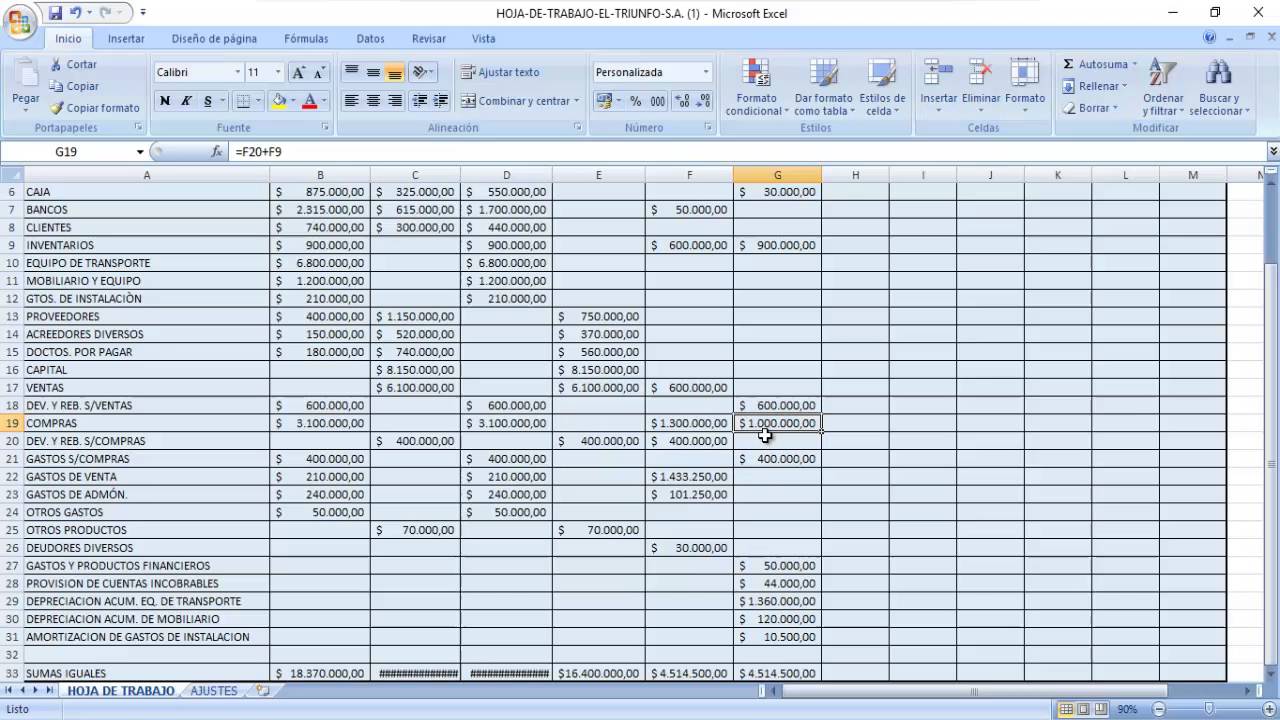

A basic "hoja de trabajo en excel contabilidad" for tracking monthly expenses might include columns for date, description, category, and amount. Formulas can then be used to calculate total expenses per category or for the entire month. More complex spreadsheets can be designed for tasks like budgeting, forecasting, and financial statement preparation. For instance, a budget spreadsheet could link income and expense projections to calculate projected profits and cash flow.

One benefit of using Excel for accounting is its accessibility. Most people are familiar with Excel, making it easy to share and collaborate on spreadsheets. Another advantage is its customizability. Users can tailor spreadsheets to their specific needs and create templates for recurring tasks. Finally, Excel offers powerful data analysis capabilities, enabling users to perform calculations, generate reports, and visualize financial information. For example, a business can create a profit and loss statement within an Excel spreadsheet (“hoja de trabajo en excel contabilidad”) and use the data to create charts showing revenue growth over time.

To effectively utilize Excel for your accounting needs, consider these best practices: 1) Maintain data integrity by validating inputs and regularly backing up files. 2) Use consistent formatting and clear labels for easy readability. 3) Leverage built-in formulas and functions to automate calculations. 4) Implement data validation rules to prevent errors. 5) Regularly review and reconcile your spreadsheets.

Frequently Asked Questions: 1. Can Excel replace dedicated accounting software? For smaller businesses, Excel can be sufficient, but larger businesses often require dedicated software. 2. How can I protect my Excel accounting spreadsheets? Use password protection and regularly back up your files. 3. Are there online resources for learning Excel for accounting? Yes, numerous online tutorials and courses are available. 4. What are some common Excel functions used in accounting? SUM, AVERAGE, IF, VLOOKUP, and SUMIF are frequently used. 5. How can I improve the accuracy of my Excel spreadsheets? Implement data validation and regularly review your work. 6. Can I use Excel for tax reporting? While Excel can assist with organizing financial data, consult a tax professional for specific advice. 7. How do I create an income statement in Excel? Use rows and columns to organize income and expense data, then use formulas to calculate totals and net income. 8. Can Excel handle multiple currencies? Yes, Excel can handle different currencies using formatting and conversion formulas.

In conclusion, leveraging Excel for accounting, especially using “hojas de trabajo en excel contabilidad,” can significantly enhance your financial management. From basic bookkeeping to complex financial analysis, Excel empowers you to organize, analyze, and interpret your financial data. By implementing best practices, utilizing its robust features, and understanding its limitations, you can unlock the full potential of Excel for accounting and achieve greater financial clarity. Start optimizing your financial management with Excel today!

Navigating the complexities of nassau county juvenile detention

Elevate your campus vibe the university of new haven store

Understanding western union money exchange rates