Verify That Wells Fargo Check Is the Real Deal

Have you received a check seemingly from Wells Fargo and wondering, "Is this Wells Fargo check I received legitimate?" It's a smart question to ask. Check fraud is a pervasive problem, and it's crucial to verify any check, especially one from a major bank like Wells Fargo, before taking action. This article will guide you through the essential steps to determine the authenticity of a Wells Fargo check and protect yourself from potential scams.

Receiving an unexpected check can be exciting, but caution is paramount. Before depositing or cashing any check, particularly a large one, take the time to verify its legitimacy. Jumping the gun can lead to significant financial headaches if the check turns out to be fraudulent. You could be held liable for the funds if you deposit a fake check, even if you weren't aware of its fraudulent nature.

Concerns about receiving a fraudulent check from Wells Fargo, or any financial institution, are completely valid. Scammers frequently impersonate legitimate organizations to trick individuals into handing over money or personal information. This can range from counterfeit cashier's checks to elaborate schemes involving fake job offers or lottery winnings. Understanding the common tactics employed by fraudsters is the first step in protecting yourself.

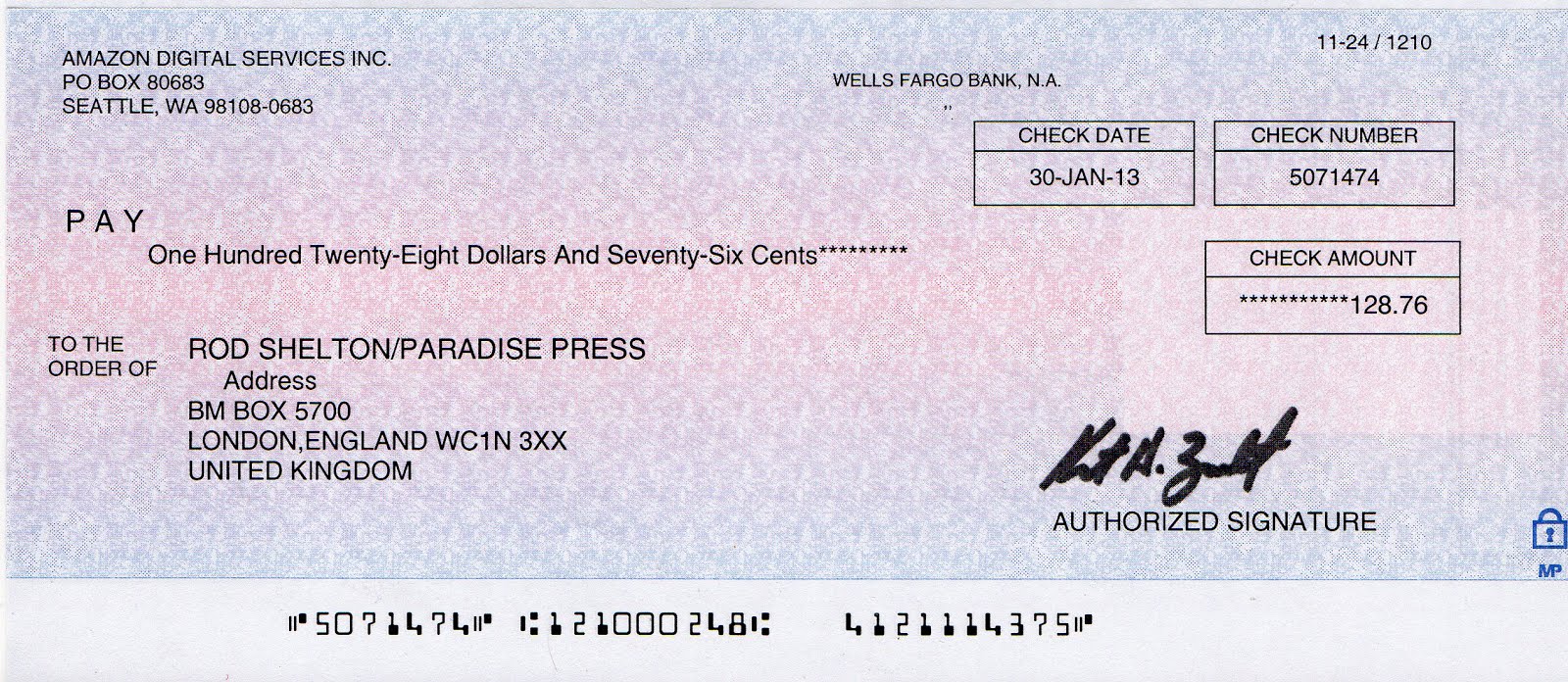

The question "Is this check from Wells Fargo real?" is frequently asked because checks can be convincingly forged. Modern printing technology makes it relatively easy for criminals to create realistic-looking checks, complete with logos and watermarks. This emphasizes the importance of verifying the check's authenticity through official channels, rather than relying solely on its appearance.

Verifying a Wells Fargo check requires a proactive approach. Don't assume its validity just because it looks official. Taking the necessary steps to authenticate the check is crucial to protecting your financial well-being and avoiding becoming a victim of fraud. This article will provide you with the knowledge and tools you need to answer the question: "I received a check from Wells Fargo, is it real?"

While the specifics of check fraud evolve, the underlying principle remains the same: criminals attempt to deceive individuals into accepting worthless checks. The "Wells Fargo check scam" can take various forms, from fake employment offers requiring you to deposit a check and wire back a portion, to unexpected "prize winnings" that come with a request for a processing fee.

If you are unsure about a check's legitimacy, contact Wells Fargo directly. Do not use the phone number printed on the check; instead, look up the official Wells Fargo customer service number online or on the back of your Wells Fargo debit or credit card. Describe the check you received and ask them to verify its authenticity.

Another option is to visit a local Wells Fargo branch. Take the check with you and ask a teller to verify it. This in-person verification provides an added layer of security.

Examine the check carefully. Look for inconsistencies like misspellings, blurry logos, or unusual check numbers. Compare the check to a legitimate Wells Fargo check if you have one available.

Advantages and Disadvantages of Verifying a Wells Fargo Check

| Advantages | Disadvantages |

|---|---|

| Protects you from financial loss | Takes time and effort |

| Prevents identity theft | May delay access to legitimate funds |

Best Practices:

1. Never deposit a check from an unknown source.

2. Contact Wells Fargo directly to verify any questionable checks.

3. Be wary of unsolicited checks, especially those related to unexpected winnings or job offers.

4. Shred any checks you suspect are fraudulent.

5. Report suspected fraud to the appropriate authorities.

FAQs:

1. What should I do if I receive a fraudulent check? Contact Wells Fargo and the authorities immediately.

2. Can I deposit a check if I'm unsure of its authenticity? It's best to verify the check first to avoid potential problems.

3. How can I tell if a Wells Fargo check is real? Contact Wells Fargo directly for verification.

4. What information do I need to provide to Wells Fargo to verify a check? The check number, amount, and payer information.

5. What are the common signs of a fake check? Misspellings, blurry logos, inconsistencies in the check design.

6. Who should I report check fraud to? Your local police department and the Federal Trade Commission (FTC).

7. Can I be held liable for depositing a fake check? Yes, even if you were unaware it was fraudulent.

8. What should I do if I’ve already deposited a fake check? Contact your bank and Wells Fargo immediately.

Tips and Tricks: When in doubt, throw it out. If anything about a check seems suspicious, err on the side of caution and don't deposit it. It's always better to be safe than sorry when dealing with potential check fraud.

In conclusion, verifying a Wells Fargo check is a critical step in protecting yourself from fraud. The question "Is this check from Wells Fargo real?" should always prompt careful investigation. By following the advice outlined in this article, including contacting Wells Fargo directly, examining the check for inconsistencies, and being wary of unsolicited checks, you can significantly reduce your risk of becoming a victim of check fraud. Remember, a few minutes of verification can save you significant financial hardship and stress in the long run. Be proactive, stay informed, and protect your financial well-being. Don't hesitate to contact Wells Fargo or the appropriate authorities if you encounter any suspicious activity. Your financial security is paramount.

The art of automotive upholstery cleaning cloth car seats

Tiny humans big waves choosing the right infant life vest

Transform your space with trending behr gray paints

/VoidedCheck-5a73c34bba6177003739388b.png)